Corporate Media Analysis Report

Beyond Meat Background

At the forefront of the plant-based protein movement, Beyond Meat, Inc. (traded on NASDAQ with the ticker BYND) is recognized for its innovative array of meat substitutes crafted from straightforward, non-GMO ingredients, free from hormones, antibiotics, and cholesterol. Established in 2009, the company’s products are engineered to emulate the taste and texture of meat derived from animals, while contributing to the wellbeing of consumers and the sustainability of the environment. The motto of Beyond Meat, “Eat What You Love®,” embodies the company’s conviction in the power of small, positive dietary shifts to enhance personal health and the global ecological landscape. Transitioning to plant-based meats can significantly influence four critical issues facing our world: human health, climate change, natural resource use, and the treatment of animals. As of June 2023, Beyond Meat’s range of products was accessible in around 190,000 retail and foodservice locations across over 75 countries globally. For more information, visit www.BeyondMeat.com.

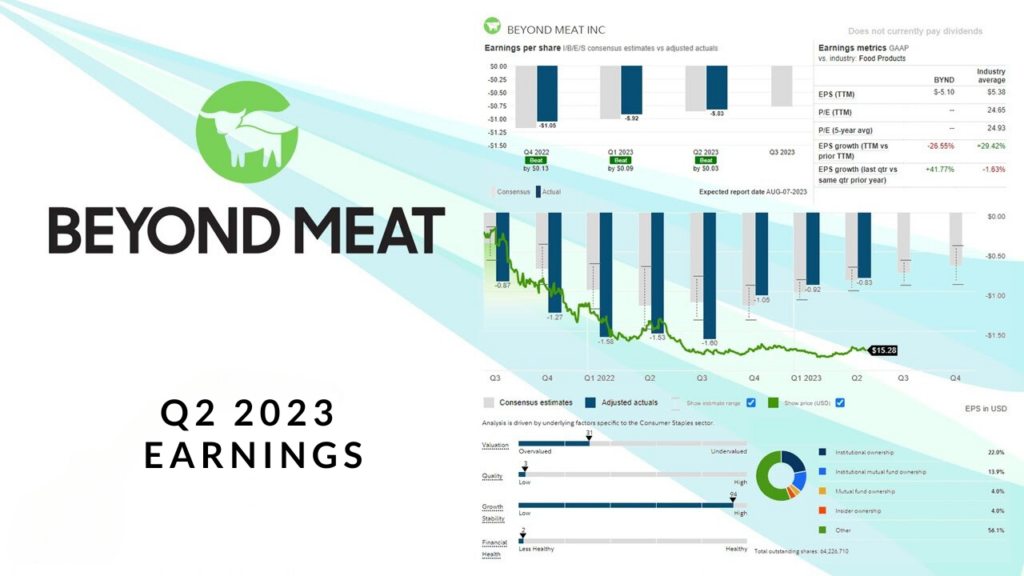

The second quarter of 2023 was a mixed bag for Beyond Meat, a company known for its plant-based meat products. Financially, the company experienced a significant downturn in net revenues, which amounted to $102.1 million, reflecting a 30.5% drop from the same period last year. However, not all news was discouraging as the company managed to report a gross profit of $2.3 million, which is an improvement considering the $6.2 million loss reported the same quarter the previous year. Gross profit margin also saw a positive turn, sitting at 2.2% of net revenues, a notable climb from the -4.2% in the year-ago period.

This financial improvement in gross profit and margin was influenced by several factors. The company benefited from reduced costs in materials and logistics per pound, alongside lower inventory reserves. These savings were slightly dampened by an increase in manufacturing costs, excluding depreciation, which was impacted by higher-cost inventory produced in the final quarter of 2022.

An important accounting change also played a significant role in Beyond Meat's financial results. The company adjusted the estimated useful lives of its large manufacturing equipment in the first quarter of 2023. This adjustment decreased the cost of goods sold (COGS) depreciation expense by approximately $5.1 million, enhancing the gross margin by 5 percentage points compared to the previous depreciation estimates.

Despite these positive signs in gross profitability, the net loss for the company remained considerable at $53.5 million, equating to $0.83 per common share. This figure, while substantial, is an improvement over the $97.1 million net loss, or $1.53 per common share, reported in the same quarter of the previous year. Additionally, the Adjusted EBITDA, which reflects the company's earnings before interest, taxes, depreciation, and amortization, adjusted for certain items, was still a loss, but it had narrowed to $40.8 million or -40.0% of net revenues. This is a slight improvement from the -46.8% of net revenues in the year-ago period.

For the average consumer, these results suggest that while Beyond Meat is still facing financial challenges, particularly with its profitability, there are signs of operational and cost management improvements. The company is still in a loss-making position, but is taking steps to reduce its losses and improve its financial health.

Even with the significant downturn in Beyond Meats net revenue, CEO Ethan Brown remains hopeful for the future, stating that the company “remain steadfast in our belief that plant-based meat, and Beyond Meat specifically, will play an important part of the global response to a climate crisis that appears to be rapidly intensifying, while also delivering health benefits to the individual consumer.”

The Motley Fool: The article titled "Why Beyond Meat Stock Soared Today" argues that despite a dip in stock value following the second quarter earnings report, Beyond Meat maintains an optimistic outlook, forecasting a healthy free cash flow of $7.6 million for the quarter. This comes as a result of the company's actions to minimize cash consumption. A boost in Beyond Meat's stock was sparked by the introduction of an aggressive cost-reduction strategy. This plan includes a significant 19% cut in corporate staff numbers, a strategic reassessment of pricing to enhance profit margins, and a series of other adjustments aimed at streamlining operations. These strategic moves have been well-received by investors, signaling renewed confidence in the company's financial management.

Yahoo!finance: According to Zacks Equity Research in their article "Beyond Meat (BYND) Q2 Earnings Upcoming: Key Factors to Note," Beyond Meat is navigating through a challenging landscape of broad economic concerns, yet it steadfastly pursues innovation. The company continues to develop its line of plant-based offerings, focusing on delivering products that are both tasty and nutritious. In a stride towards expanding their product portfolio, Beyond Meat has introduced an updated version of their Beyond Sausage. This renovated product contains 40% less saturated fat compared to standard pork sausages, further cementing the company's commitment to healthier alternatives for consumers without compromising on flavor. This may have contributed to a small boost in their fiscal second-quarter performance.

CNN BUSINESS: CNN’s coverage, "Beyond Meat earnings drop 30% with falling demand," draws attention to the increasing competition in the plant-based sector. The article points to growing challenges from newer competitors and established food giants, and discusses how rising inflation has led consumers to opt for more affordable essentials and grocery stores, causing them to dine at home rather than eating out.

Bloomberg: Bloomberg’s article titled “Fake Meat Was Supposed to Save the World. It Became Just Another Fad,” discusses potential concerns regarding the company's profit margins. The article references the rising costs of raw materials and the falling demand for plant based products. Initially, plant-based burgers and sausages were thought to be a healthier alternative to America's consumption of red and processed meats, which are associated with cancer and other health issues. However, over time, doubts about their health benefits have increased and many criticized Beyond Meat’s products for being overly-processed.

Forbes: A Forbes article titled “Will Beyond Meat Stock See Further Declines?” highlights the challenges faced by Beyond Meat, including low utilization of plants, declining sales per pound, and ended partnerships with manufacturers. The company is also carrying a large debt load, which is increasingly risky as interest rates rise. Beyond Meat's balance sheet shows $1.1 billion in debt, and its available cash has decreased to $258.6 million, a drop from $310 million at the end of 2022.

In order to return to revenue growth and deliver a sustainable profit, Beyond Meat needs to do at least one of two things. It needs to find a way to lower costs so it can reduce prices to be more competitive with animal-based protein, or it must improve the taste of its product so it's more desirable to its target market of "flexitarians," meat-eaters who are willing to eat vegetarian foods.

If US consumers are still strapped for cash and don’t necessarily see the health or environmental benefits of plant-based meat, why do you have the conviction [that things will get better]?